Recently I was interviewed by Claire Heaney from www.HeraldSun.com.au to talk about our younger generation and the investment opportunities that are available to them.

Recently I was interviewed by Claire Heaney from www.HeraldSun.com.au to talk about our younger generation and the investment opportunities that are available to them.

This prompted me to write an article about this topic and delve further into a subject that seems to be on the minds of not only the young investors in question, but their parents.

Why Young People Are Investing in Businesses, Shares and Super Instead of Real Estate

Every generation has its investment preferences, and that includes the generation coming of age in Australia right now. The Baby Boomers went through life believing:

- They should buy and hold onto real estate;

- They should put money into their company pension;

- They should enjoy their prosperity.

All of this is well and good, but the forward progress of time has brought changes to the Australian economy that have created different opinions about how to prosper in the younger generations.

In 1992, the laws regarding an employee’s super were changed to make employee contributions mandatory. Recently, those laws were changed again to increase the amount employers are responsible for contributing. At the time, increasing employee investment in a super seemed like an idea that yielded decent results.

Today, putting money into a super, along with other investments, makes a lot more sense than investing in real estate.

Why Younger Generations Are Shying Away From Real Estate

For the last 20 years, real estate has appeared to be a solid investment for everyone. But there has been a couple of changes to the Australian real estate market that are causing younger people to shy away from investing in real estate.

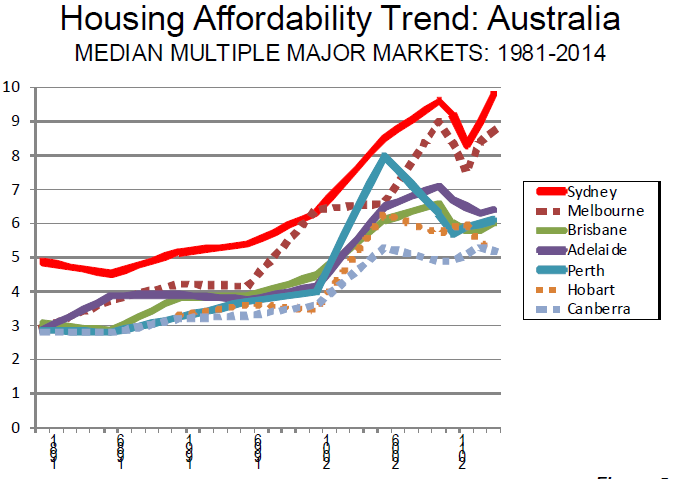

For one thing, the housing bubble in Australia has helped to increase prices to the point where property ownership seems almost out of reach. While a property increasing in value over the last 20 years seems great to the person who bought it 20 years ago, that increased value is not sitting well with younger investors today.

Some suburbs now have a median price of well over $1 million, making the 10% to 20% deposit as much as $200k. Not to mention the other costs involved such as insurances, stamp duty and interest from the banks ‘loan to value’ algorithms.

Is Saving for a Deposit Enough

Long gone are the days of saving for a deposit so you can buy your first home as the prices are simply too high for first time buyers.

Saving for the deposit is hard enough, but the issue now is not only the hefty price bracket, but servicing such a huge loan required to enter the real estate market in Australia is simply out of reach for the average twenty something’s or first time buyers, especially on a single income!

Property prices around Australia have exceeded expectations of all experts in the field over the past 3 years, with houses in the major cities (in particular Sydney) fetching the highest prices on record.

The Investment Alternatives

Instead of real estate, younger investors are putting their money into:

- Businesses;

- Shares;

- Super Accounts.

Small Businesses Are Booming

The growing Australian economy makes investing in small businesses and buying shares smart moves. The Australian Bureau of Statistics announced that 20,496 new businesses started in Australia from June 2013 to June 2014. As that number continues to increase, young investors are finding plenty of small businesses to invest in.

Now Is The Time To Buy Shares

The reason that shares are so appealing is because the Australian stock market is in the midst of a recovery from an historic low in late August, and the opportunity is there for investors to buy low. Young investors are using the Internet to become more stock market savvy, and are discovering that buying low in a recovering market is a great way to make money.

Supers Make Sense

The mandatory employer contribution rate for an employee super in 2013 was nine percent. Over the next few years, that rate is gradually being increased to 12 percent. An employee super is a retirement option that is relatively new to Australian workers, and it is something that younger investors are learning about very quickly. As employer contributions increase and interest rates for a recovering economy continue to go up, it makes sense for young investors to put more into their supers now than ever before.

Buying Their Own Businesses

The increase in small businesses in Australia has not only inspired young investors to become involved in the country’s economic growth, it has convinced them to become a part of that ongoing recovery. Many young investors are looking to buy their own established businesses to take advantage of the recovering economy, and grab their share of the proliferation of spending cash that has started to appear in the Australian economy.

Younger investors do not see the same value in real estate that older investors saw, and with very good reason. The economic climate continues to be more favorable towards shares and business investments than real estate, and younger investors are taking advantage of everything the new economy has to offer.

Herald Sun Interview Transcript

Young Guns Branch Out

Young people priced out of the residential property market are turning to businesses to create a job and a nest egg.

They also are looking to shares and superannuation, businesssold.com.au cheif executive Peter Watson said.

Mr Watson said that in an environment of low interest rates it was ‘not impossible’ for the younger generation to get themselves into a business.

“Because residential property is out of the reach of a lot of the younger people they are often looking to buy an already existing business,” he said.

Mr Watson said often the businesses were funded buy banks and some financial input from parents.

He said food industries and online businesses, the latter often based at home, were popular.

The three main influencers into purchases were, industry, location and price. Manufacturing industries tended to take a bit longer to move as they required specialised training or previous experience.

Council of Small Business of Australia chief executive Peter Strong said it was great to hear anecdotally of new business owners.

“I would tell them the first thing they need to do is get themselves some really good advise,” he said.

“They need to get someone who is not emotionally attached to the business who gets business as a mentor.”

He said getting into business was a big learning curve.

Mr Watson said there was keen interest in franchises business people needed to do their due diligence.

He said up to 9% of his traffic was from China although that did not translate into 9% of sales.

Mr Watson said people with an eye to selling their businesses should be running them as if they were permanently on the market.

“When you first open your business, you have no intention of selling it anytime soon. However, you can constantly raise the value of your business if you act as though you are trying to attract potential buyers,” he said.

“He said constant increases in the business indicators over the long haul, rather than in the months leading up to the business being on the market as costs are cut and the business is made sale ready, look more impressive.”

“The worst time to start adopting effective business policies is in the months leading up to the sale of the business. It is always best to adopt these important policies from day one and continue to develop those policies as the company and the marketplace change,” he said.

Mr Watson said it was important to have good staff.

“Never settle for mediocre employees,” he said.